By Salman Siddiqui

☸ Popular CNIs in Kubernetes (2025)

The landscape of Kubernetes Container Network Interfaces (CNIs) in 2024–2025 is divided into two distinct categories: Default Cloud Provider CNIs (which hold the largest raw market share due to managed Kubernetes dominance) and Independent Third-Party CNIs (which are chosen by architects for specific features like security, observability, or on-premise scale).

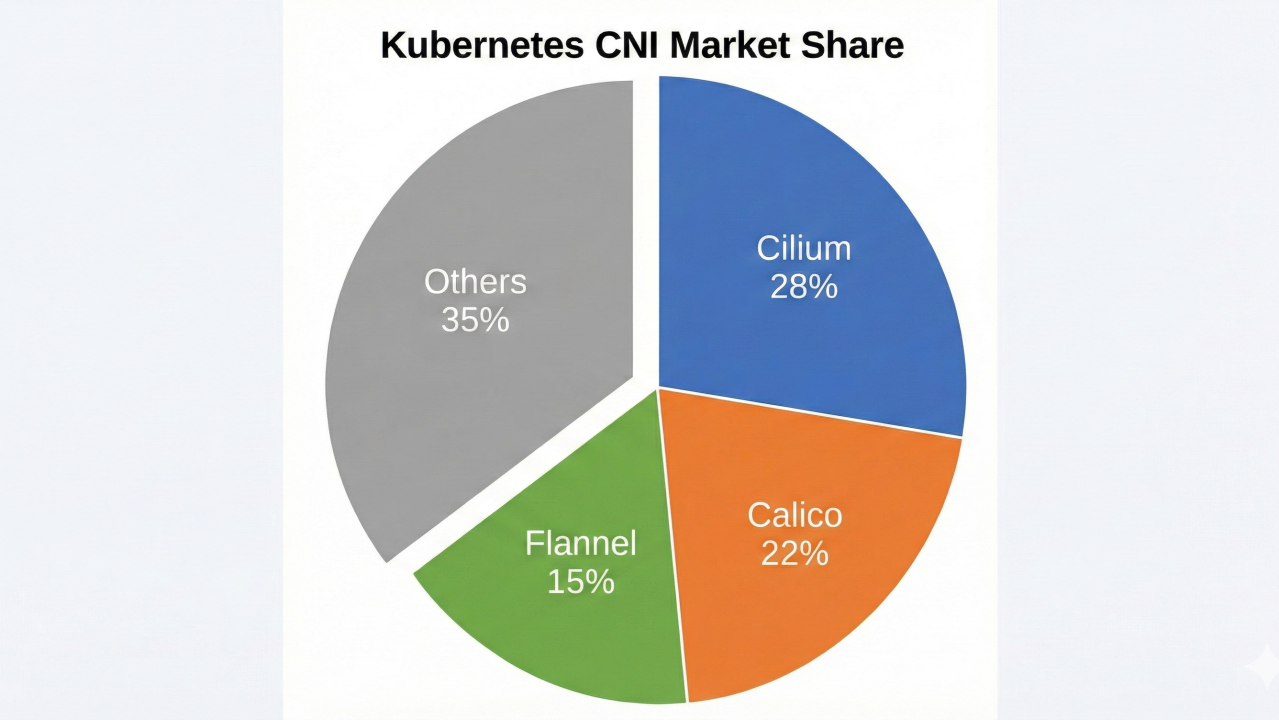

🌐 Market Share Overview

Gemini puts Cilium slightly ahead while Copilot puts Calico slightly ahead based on CNCF ecosystem surveys, Isovalent’s State of Kubernetes Networking Report 2025, and independent CNI benchmark studies.

1. Calico

- Strengths: Enterprise-grade network policies, BGP routing, hybrid/multi-cloud support.

- Why popular: Widely adopted in regulated industries (finance, healthcare) due to its policy enforcement and compliance features.

- Use case: Large-scale production clusters needing fine-grained security controls.

2. Cilium

- Strengths: Built on eBPF, offering high throughput, low latency, and advanced observability (via Hubble).

- Why popular: Rapidly growing adoption in AI/ML pipelines and high-traffic web apps because of its performance edge and native service mesh capabilities.

- Use case: Clusters with bandwidth-heavy east-west traffic or requiring deep observability.

3. Flannel

- Strengths: Simple overlay networking (VXLAN/host-gw).

- Why popular: Lightweight and easy to deploy, often used in dev/test clusters or smaller production setups.

- Use case: Teams prioritizing simplicity over advanced features.

4. Canal

- Strengths: Combines Flannel’s simplicity with Calico’s policy enforcement.

- Why popular: Transitional choice for teams moving from Flannel to Calico.

- Use case: Mid-sized clusters needing basic policies without full Calico complexity.

5. Weave Net

- Strengths: Simple overlay, automatic peer discovery.

- Why popular: Still used in smaller clusters, but declining due to performance overhead compared to Cilium/Calico.

- Use case: Legacy or small-scale deployments.

📊 Market Share Snapshot (2025)

| CNI | Approx. Market Share | Key Adoption Drivers |

|---|---|---|

| Calico | 40–45% | Security, compliance, hybrid cloud |

| Cilium | 30–35% | Performance, observability, eBPF |

| Flannel | 15–20% | Simplicity, dev/test clusters |

| Canal | 5–7% | Transition from Flannel, basic policies |

| Weave | 3–5% | Legacy/simple setups |

Sources: CNCF ecosystem surveys, Isovalent’s State of Kubernetes Networking Report 2025, and independent CNI benchmark studies.

⛅ The Hidden Giants: Cloud Provider CNIs

If you count default installations in managed Kubernetes (which makes up ~63% of the total market), provider-specific CNIs actually have the highest installation base.

- AWS VPC CNI:

- Share: Dominates the AWS ecosystem (EKS holds ~30% of the total Kubernetes market).

- Why it's popular: It gives Pods real VPC IP addresses, offering the highest performance on AWS. Most large-scale EKS users stick with this unless they hit IP exhaustion limits.

- Azure CNI:

- Share: Default for Azure Kubernetes Service (AKS).

- Why it's popular: Deep integration with Azure VNets. Microsoft now offers Azure CNI powered by Cilium for larger scales to overcome legacy performance limits.

🍑 The bottom line is that if you are on a public cloud such as Azure or AWS, your best bet is to swallow the bitter pill of vendor lock-in and use the provider CNI.

🔑 Takeaway

- Calico dominates where security and compliance are critical.

- Cilium is surging thanks to eBPF performance and observability.

- Flannel remains relevant for simplicity, but its share is shrinking in production-scale clusters.

- Canal and Weave are niche, transitional, or legacy choices.

👉 For large-scale, production-grade deployments of 1,000+ Nodes and High Throughput requirements, the decision often comes down to Calico vs. Cilium:

- Choose Calico if policy enforcement and compliance are top priorities. Calico is the battle-tested workhorse. It is easier to troubleshoot for traditional network engineers because it uses standard BGP (Border Gateway Protocol) for routing. Key Feature: Its Network Policy engine is arguably the industry standard; even other CNIs (like AWS VPC CNI) often use Calico just for the policy enforcement layer. However, observability remains a challenge.

- Choose Cilium if performance, observability, and future-proofing with eBPF matter most. Cilium uses eBPF (Extended Berkeley Packet Filter) technology, which bypasses the Linux iptables bottleneck that slows down traditional CNIs (like Flannel or standard Calico). Key Feature: Hubble (built-in observability) lets you visualize network traffic overhead-free. Adoption: Used by hyperscalers (Google GKE Dataplane V2 is based on Cilium) and massive SaaS platforms.

For Large-Scale Applications (1,000+ Nodes / High Throughput) the Winner is: Cilium, but I personally recommend it even for smaller deployments for simplified observability and L2 announcements for BGP free LAN routing.

Elephant in the Room

Canal, Weave and un-named others enjoy a large slice of the pie due to their presence in legacy infrastructure, school/lab environments, or simply because the operations are staffed for skills in these CNI's. Is it inevitable that the Cilium-Calico duo will take over this market? Only time will tell. The aspirants to the largest slice will need to step up their efforts to make the learning curve for their products easier to climb. Cilium appears to have grasped this very well.